Online Trading With Exness: A Comprehensive Guide

In today’s fast-paced finance world, Online Trading With Exness online trading with Exness offers unique opportunities for both novice and experienced traders. With advanced technologies and market access, trading online has never been more accessible. In this guide, we will explore what Exness offers, how to get started, and strategies for success.

What is Exness?

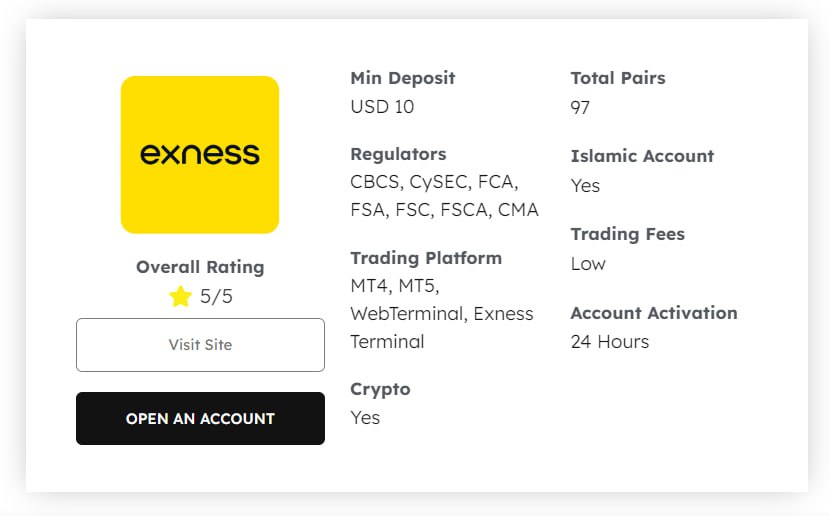

Founded in 2008, Exness has grown significantly, becoming a reputable brokerage catering to over 200,000 clients worldwide. It provides a robust platform for trading on various financial instruments, including Forex, stocks, indices, and cryptocurrencies. Exness is renowned for its user-friendly interface, competitive spreads, and high execution speeds, making it a favorite among traders.

Why Choose Exness for Online Trading?

There are several compelling reasons to choose Exness as your online trading platform:

- Regulation and Security: Exness is regulated by top-tier authorities, ensuring a safe trading environment. Clients’ funds are kept secure in segregated accounts.

- Diverse Trading Instruments: With Exness, traders can access a wide range of assets, enabling diversification and broader market exposure.

- Competitive Spreads: Exness offers low spreads and no commissions on certain accounts, increasing your potential for profit.

- Flexible Leverage: The leverage options provided by Exness can help traders maximize their potential returns while managing risk.

- 24/7 Customer Support: Exness offers round-the-clock customer support, ensuring that traders receive assistance whenever needed.

Getting Started with Exness

1. Create an Account: To start trading, you first need to register on the Exness website. The registration process is straightforward and requires minimal information to create your profile.

2. Verify Your Account: After registration, you need to verify your account for security purposes. This involves submitting identification documents. Once approved, you will gain access to your trading account.

3. Deposit Funds: Fund your trading account using one of the many available payment methods, including credit/debit cards, e-wallets, and bank transfers. Exness supports multiple currencies, making it easier for you to deposit.

4. Start Trading: After funding your account, you can start trading. Download the MetaTrader platform, which is popular among traders for its versatility and features.

Understanding Trading Concepts

Before diving into trading, it’s essential to grasp key concepts such as:

- Pips: The smallest price move in currency exchange rates. Understanding pips will help you gauge your profit and loss.

- Lot Size: Refers to the number of units you buy or sell. Learning about lot sizes is crucial for effective risk management.

- Leverage: This allows you to control larger positions with a smaller capital outlay. While it can magnify profits, it also increases risks.

Trading Strategies for Success

Implementing effective trading strategies can significantly boost your chances of success. Below are some popular strategies:

1. Day Trading

Day trading involves opening and closing trades within the same day. This strategy capitalizes on short-term price movements and requires constant market analysis. Traders typically focus on charts and technical indicators.

2. Swing Trading

Swing trading aims to capture price swings over a few days or weeks. Traders use various technical methods to find entry and exit points and may also consider fundamental analysis to inform their strategies.

3. Scalping

This strategy focuses on making small profits from numerous trades throughout the day. Scalpers rely on tight spreads and quick execution, often holding positions for just a few minutes.

4. Position Trading

Position trading is a longer-term strategy where traders hold positions for several weeks or months, typically based on fundamental analysis. This approach requires less frequent monitoring and can lead to substantial returns over time.

Risk Management in Trading

Risk management is crucial to successful trading. Without proper risk management, even the best strategies can lead to significant losses. Here are some essential tips:

- Set Stop-Loss Orders: Implementing stop-loss orders helps limit potential losses by automatically closing trades at a predefined price.

- Diversify Your Portfolio: Avoid putting all your capital into a single trade or asset. Diversifying helps spread risk across different instruments.

- Practice Proper Position Sizing: Use appropriate lot sizes to ensure that any potential loss does not threaten your trading account.

Conclusion

Online trading with Exness offers traders a remarkable platform filled with opportunities. With its user-friendly interface, solid regulatory standing, and comprehensive support for diverse trading strategies, traders can navigate the markets effectively. By understanding core concepts and employing effective trading techniques, anyone can increase their chances of success. Remember, consistent practice and discipline are key to mastering online trading.